What is Forex trading?

Discover how forex trading works, what drives the market, and how to trade 70+ currency pairs with industry leading trading conditions.

Discover how forex trading works, what drives the market, and how to trade 70+ currency pairs with industry leading trading conditions.

Trading forex involves buying one currency and selling another simultaneously. Through careful analysis, traders predict the potential direction of currency prices and attempt to take advantage of price fluctuations. There is no centralised exchange for forex trading. Rather, it takes place electronically or online, between networks of global computers. The forex market is open 24 hours a day, five days a week.

In forex trading, currencies are quoted in pairs such as the EUR/USD. Buying this pair means purchasing euros (EUR) while selling US dollars (USD). Conversely, selling the EUR/USD means selling euros and buying US dollars.

Thanks to advances in technology, traders can access the foreign exchange market via online brokers. This is done using forex trading platforms such as MetaTrader 4, MetaTrader 5, cTrader and TradingView. Read more on How do I trade Forex?

Online trading has also facilitated the rise of Contracts for Difference (CFD), a form of leveraged trading. These are leveraged products which allow traders to open a position with an initial investment that is only a fraction of the value of the full trade.

Forex is the most popular over-the-counter (OTC) market. In forex, currencies are bought and sold through a network of banks. As there is no exchange, forex trading is decentralised and trading can take place 24 hours per day. There are four main trading sessions, namely Sydney, London, New York and Tokyo.

The most popular forex market type is the spot forex market. In forex, spot trades involve the exchange of currency pairs electronically using an online trading platform. Other market types include the forward forex market and futures forex market.

Keep in mind that timings in some countries, like Australia, the US and UK, shift to/from daylight savings time in October/November and March/April. So, plan your trades accordingly. Market liquidity for currency pairs depends on the forex trading sessions. For instance, the EUR/USD pair shows a lot of movement and liquidity during the confluence of the London and New York sessions. The AUD/USD pair shows maximum movement in the Tokyo and London sessions. Once you know when it would be better for you to trade, the next step is to learn the trading jargon. So, here are some terms and concepts you will come across in the market.

Sydney Session

03:00 pm – 12:00 am

(EST)

Tokyo Session

07:00 pm – 04:00 am

(EST)

London Session

03:00 am – 11:00 am

(EST)

New York Session

08:00 am – 05:00 pm

(EST)

Currencies are denoted in 3-letter ISO codes. Examples of how major currencies are denoted are USD (US dollar), AUD (Australian dollar), EUR (Euro), JPY (Japanese yen) and GBP (British Pound).

In foreign currency trading, currencies are quoted in pairs. When you see a currency pair, the first (left side) currency is called the base currency and the second (right side) currency is the quote currency or counter currency. For instance, say the EUR/AUD is trading at 1.6163. This means to buy 1 unit of Euro, you will need $1.6163 Australian dollars.

The foreign exchange (forex) market is the largest and most liquid financial market in the world. Understanding how the forex market works and which are the forces behind forex market fluctuations is essential for every trader, whether beginner or more experienced.

As the forex market is decentralised, it is the world's largest banks that can influence currencies’ exchange rates. Major global banks such as Barclays, HSBC, Citi, JPMorgan and Deutsche Bank are among the biggest traders of forex, influencing currency pricing in the interbank market.

Large global corporations are involved in the foreign exchange market for the purpose of converting currencies and managing foreign revenue and expenses. For example, if an Australian-based company is selling products in the United States (US) they will have to trade USD to AUD in order to repatriate their income.

Retail traders are individuals who trade their own money in order to make a profit. Traders get access to the forex market via trading platforms offered by brokers. Although their share of total volume is smaller compared to financial institutions, they do play an important part in the daily forex activity.

Central banks such as the US Federal Reserve (Fed), the Bank of England (BoE) and the European Central Bank (ECB) can influence the forex market using tools like interest rates, monetary policy decisions and market interventions. Central bank announcements tend to impact currency exchange rates, especially if they are not in line with market expectations.

Conflicts, trade disputes, political instability or elections are key events that can create market uncertainty and lead to sharp currency moves. This is evident by historical events such as Brexit in the United Kingdom and many presidential election campaigns in the United States.

Economic data releases like Gross Domestic Product (GDP), Consumer Price Index (CPI) and employment figures can affect currency valuations. Such data reports are scrutinised by economists as they offer insights into overall economic performance.

Not all currency pairs are traded in large volumes. The US Dollar, being the world’s reserve currency, is traded the most; although, over the years, its dominance has waned somewhat. Based on how frequently they are traded, currency pairs are segregated into major, minor and exotic categories.

Major currency pairs have the tightest spreads.They are:

EUR/USD

Euro/US Dollar (aka Fiber)

GBP/USD

British Pound/US Dollar (aka Cable)

USD/JPY

US Dollar/Japanese Yen (aka Ninja)

USD/CHF

US Dollar/Swiss Franc (aka Swissy)

CAD/USD

Canadian Dollar/US Dollar (aka Loonie)

AUD/USD

Australian Dollar/US Dollar (aka Aussie)

NZD/USD

New Zealand Dollar/US Dollar (aka Kiwi)

Then comes a category of minor currency pairs, otherwise known as cross-currency pairs. They are called so because they do not include the US Dollar. So, to convert one into the other, the US Dollar will need to act as a mediating currency. A few of the minor pairs are:

EUR/GBP

Euro/British Pound (aka Chunnel)

EUR/AUD

Euro/Australian Dollar

CHF/JPY

Swiss Franc/Japanese Yen

GBP/JPY

British Pound/Japanese Yen (aka Gopher)

GBP/CAD

British Pound/Canadian Dollar

Exotic currencies can include a major currency with an emerging market currency. Trading in exotics is considered risky, since they tend to have low liquidity, wider spreads and political instabilities in these countries can make these currencies volatile. Some examples are:

USD/HKD

US Dollar/Hong Kong Dollar

AUD/MXN

Australian Dollar/Mexican Peso

*In the brackets are the common nicknames for these currency pairs.

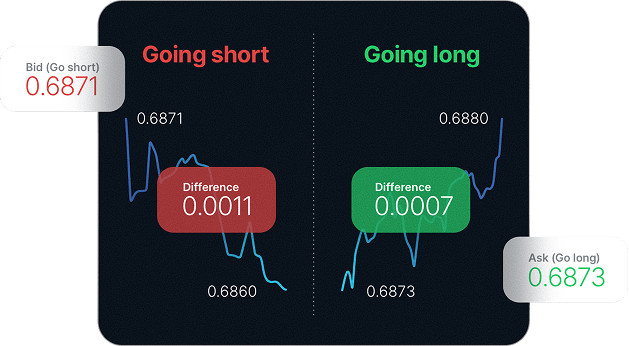

When you take a long position in a currency pair, you are buying the base currency and selling the quote currency. Traders do this in anticipation that the base currency will appreciate (rise) relative to the quote currency.

When you take a short position in a currency pair, you are selling the base currency, expecting it to depreciate (decline in price) relative to the quote currency in the future. If the pair’s price falls, you can close your position at a lower rate and profit from the difference.

When you decide on your position size, a term you will hear is ‘lot’. Lots are standardised position sizes for currencies. The forex market gives you the flexibility to trade according to your means and risk profile. The standard size for a lot is 100,000 units of the base currency. There also are mini and micro lot sizes that contain 10,000 and 1,000 units of the base currency, respectively.

Liquidity in the forex market refers to how easily a currency pair can be bought or sold without significantly affecting its exchange rate. When you trade in major currency pairs, there are a lot of buyers and sellers in the market.

Major currency pairs, such as EUR/USD or USD/JPY, are highly liquid due to the large number of participants and frequent trading activity. This ensures that traders can typically enter or exit positions quickly and at stable prices.

Liquidity tends to fluctuate during trading sessions. You are likely to see significant activity during the overlapping of the New York and London sessions. Short-term traders often prefer these periods due to increased volatility and larger price movements.

Although high liquidity can help reduce price slippage and keep spreads tight, it does not eliminate volatility. Important news updates, central bank announcements regarding monetary policies, or geopolitical developments can still cause sharp price swings, affecting even the most liquid currency pairs.

Leverage is a financial tool that allows traders to control a larger position in the market with a relatively small amount of capital. For example, with a 1:100 leverage ratio, a trader can enter a position worth US$100,000 with just US$1,000 in their account.

The leverage ratio is provided by the forex broker. Traders should view leverage as a form of credit, not free capital. Leverage can amplify gains but it should be noted that it could also enhance losses, if markets move against your plans. That’s why traders are advised to put in place robust risk management strategies while executing their trading strategies.

If you have decided to trade, you will need to open a margin account with a regulated broker. The initial capital you deposit to open and maintain positions is known as the margin requirement. If your margin level falls below the required level, your broker may issue a margin call – a request to deposit additional funds. If the margin call is not met, the broker may close your positions to prevent further losses.

A 1:50 leverage ratio means a minimum margin requirement of 1/50, or 2% of the total trade value from you. Similarly, a 1:100 leverage ratio means that you need to deposit at least 1% of the total value of your trade in your margin account.

The main difference between the two is that Forex is limited to currencies while Contracts for Difference (CFD) cover a broader range of asset classes, including Shares, Indices, Commodities, Bonds and Cryptocurrencies.

Find out more about the Similarities and Differences Between Forex and CFDs.

This depends on a number of factors including the currency you wish to trade, any time limitations and trading strategies. It is important to note that the forex market is most active when major trading sessions overlap.

For further details about forex trading hours and the most actively traded currencies, click here.

MetaTrader 4 (MT4) is one of the most popular trading platforms in the world. Specifically designed for forex trading, it has an array of features and tools that help provide a comprehensive trading experience. Those who are looking for a more elaborate platform can consider MetaTrader 5 (MT5), the latest upgrade from MetaQuotes. Traders that would like to test other platform options will find that FP Markets offers the cTrader and TradingView. Read Top Forex Trading Platforms to help decide which is best for you.

Algorithmic trading is trading based on an algorithm or set of computer programs that include a specific set of rules to execute market orders such as stop-loss orders. Expert Advisors (EAs) and copy trading software such as AutoTrade are examples of algorithmic trading.

Learn more about Algorithmic Trading.

International and local financial regulatory bodies and agencies, including the Financial Stability Board (FSB), the European Securities and Market Authority (ESMA), the Islamic Financial Services Board (IFSB), the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC) set prudential standards, regulations and guiding principles for the effective and sound supervision of the financial industry and the forex market to ensure investor protection and successful development of the securities market. A forex broker must comply with all set standards under the jurisdictions it is registered or licensed and must undergo regular audits.

Forex rates are influenced by a wide range of economic factors that reflect a country’s financial health and stability. These factors can impact the supply and demand for a currency, causing its value to rise or fall in the global market. Understanding these drivers helps traders anticipate currency movements and make informed decisions.

Forex trading involves the exchange of one currency for another in pairs (e.g. EUR/USD), taking advantage of high liquidity and price movements. The forex trading market is open 24 hours a day and can be influenced by various macroeconomic factors such as interest rate decisions, inflation data and geopolitical events among others.

In contrast, stock trading is about buying and selling company shares. Although company share values can be influenced by macroeconomic factors mentioned earlier, they can be impacted by company-related factors such as earnings reports, senior management changes, as well as industry trends.Stock markets operate during set hours and are considered less volatile than the forex market; however, this can depend on market conditions.

By registering, you agree to FP Markets’ Privacy Policy and consent to receiving marketing materials from FP Markets in the future. You can unsubscribe at any time.

Quick Start & Resources

Markets

Tools & Platforms

Trading Info

About Us

Regulation & Licence